When taking out your first personal loan, you must know specific information so that potential lenders can verify it and be aware of it. It may include some familiar things, like your income. However, you may want to check others first, such as your credit score, before applying for the loan. Let’s discuss what you should know before you apply:

Credit History And Score

You demonstrate to lenders that you pay off your credit obligations on time if your credit score and credit history are good. An excellent credit score will increase obtaining a loan with favourable terms. You can save thousands of money over the loan’s lifetime by getting the best times.

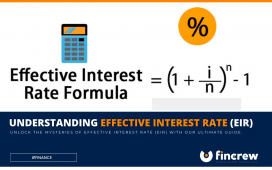

Interest Rate

Several factors determine your interest rate, including your credit score, the loan amount and the term. Interest rates are from 3.49% to 29.99%. Of course, you’ll get the lowest rate when you have an excellent or good credit score and choose the shortest repayment term.

Is It Affordable For Me To Make The Monthly Payment?

Personal loans offer you repayment plans that work best based on your income level and cash flow. In some cases, lenders will provide incentives for using autopay, lowering your APR by 0.25 to 0.50 per cent. Many people prefer to reduce their monthly payments by paying back their loans over a long period. Others choose the highest monthly payment to pay off their loan as soon as possible. Choosing a longer repayment term and low monthly payments come with the highest interest rates. However, you may not realize it since the monthly payments are smaller, but you pay more for the loan in the long run. They recommend borrowers shouldn’t spend more than 35% to 43% of their income on debt, such as mortgages, car loans, and personal loans. So, if you earn RM4,000 each month, you should ideally keep your total debt obligations at or under RM1,720 each month.

When Do You Need The Funds?

Funds from some personal loan lenders are delivered electronically the same day you are approved or the next business day. Other lenders may take ten days. Choose lenders with fast delivery if fast access to funds is vital to your situation.

Are There Fees Associated With The Personal Loan?

Most personal loan lenders do not charge fees other than interest. However, a sign-up fee, or origination fee, may be charged by some lenders. A lender deducts an origination fee from your loan as a one-time upfront charge to cover administration and processing costs. Prices usually range from 1% to 5%, although sometimes they are flat rates.

Employer’s Contact Details

Most likely, you’ll have to provide your current employer’s contact information and maybe information about a past employer. Your lender may contact your present and past employers for references or verify your income and employment dates.

Final Thought

There are many advantages to getting a personal loan instead of 0% APR credit cards. However, you are most likely to benefit from them when you have a plan. You can see options without hurting your credit score by making a soft inquiry on the lender’s website or a third-party lending marketplace once you have reviewed the above questions. Once you see what you prequalify for, you should make a hard inquiry.