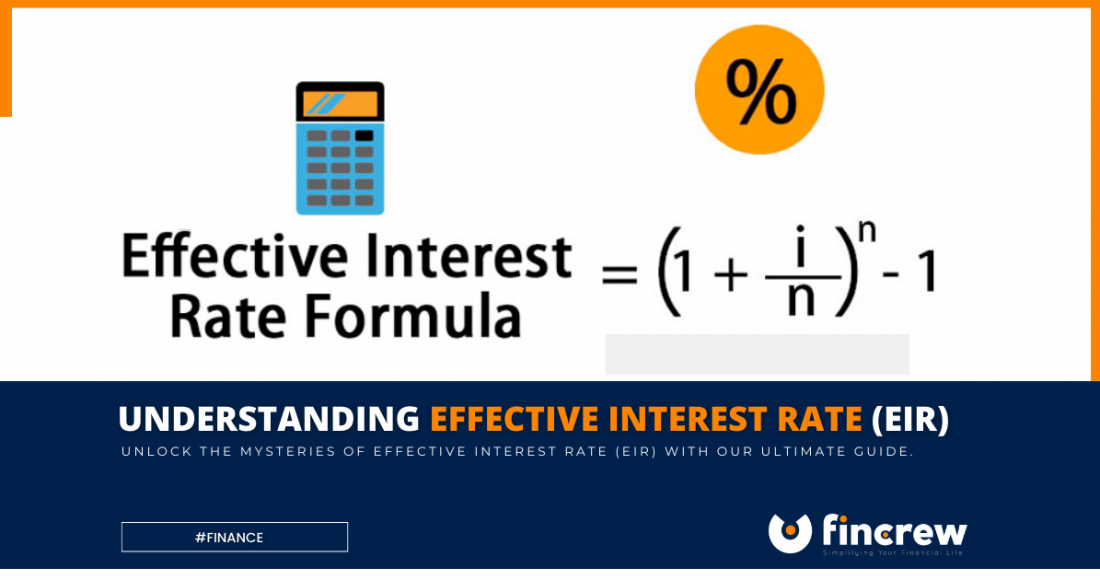

Whether it’s to pursue higher education, get a car for work, or finally buy that dream house, sooner or later, one option we explore to secure the necessary funds is taking loans. And while there’s nothing wrong with taking on debt to help you realize your dream, you must know what you’re getting yourself into from the beginning. It is because that’s the only way to make an informed financial decision. To that end, one term you need to familiarize yourself with is Effective Interest Rate, or EIR, for short.

What Exactly Is Effective Interest Rate?

EIRs are the actual interest rate you will pay on your loan once they consider the loan tenure. It means that the EIR of a loan determines how much you’ll be paying in interest. Because of this, Effective Interest Rate is a variable that you must never overlook when trying to secure a loan. The lower an EIR is, the better that loan might be for you!

Types of Interest Rates to Know

When determining EIR, one major influencing factor to always take note of is the type of interest rate that the loan is operating. Along these lines, you should know two types of interest rates. These are:

1. Flat Interest Rate

In basic terms, a borrower pays a fixed interest rate on the principal they borrowed from the start of the loan term till the end. It means that, no matter how far along they get with clearing their principal, the amount of interest they have to pay remains the same. If, for example, you take a loan of RM 1 000 for a 5-year loan at a flat interest rate of 4%, you’ll end up paying a yearly interest of RM 40. As such, by the end of the loan term, what you’ll pay in interest alone will be RM 200!

2. Reducing Balance Interest Rate

With this type of loan, they recalculate the interest after each payment. The reason is that what you pay as interest is expected to reduce the more you cut into the principal. So, just like with our first example, if you take a loan of RM 1, 000 for a 5-year loan at a reducing balance interest rate of 4%, by the end of the loan term, what you’ll have paid in interest will be no more than RM 105. So, even though the interest rate on both loans is the same, the Effective Interest Rate that these two interest types give you ensures that you end up paying more for one loan than you would for another.

Conclusion

Now that you know just how necessary EIR is make sure you don’t take any loan without first understanding how this element influences what you’ll ultimately have to pay.