When your car is severely damaged because of an event, your company may declare a loss. However, whether you have comprehensive or collision insurance, you might receive a total-loss settlement from your insurer.

What Is a Total Loss?

A total loss auto insurance policy covers the cost of repairing a damaged vehicle when it is beyond repair. You need to contact your auto insurer if you believe your vehicle has been damaged beyond reasonable repair. The adjuster will examine your vehicle’s worth by assessing certain damages and other factors that depreciate its value. Then, using this information and the market value of your car, the company determines how much your vehicle is worth. The amount they arrive at is the actual cash value (ACV). Under the terms of total loss coverage, an insurance company will pay for a totaled vehicle even if it is worth less than repairs would cost.

How Is Total Loss Calculated

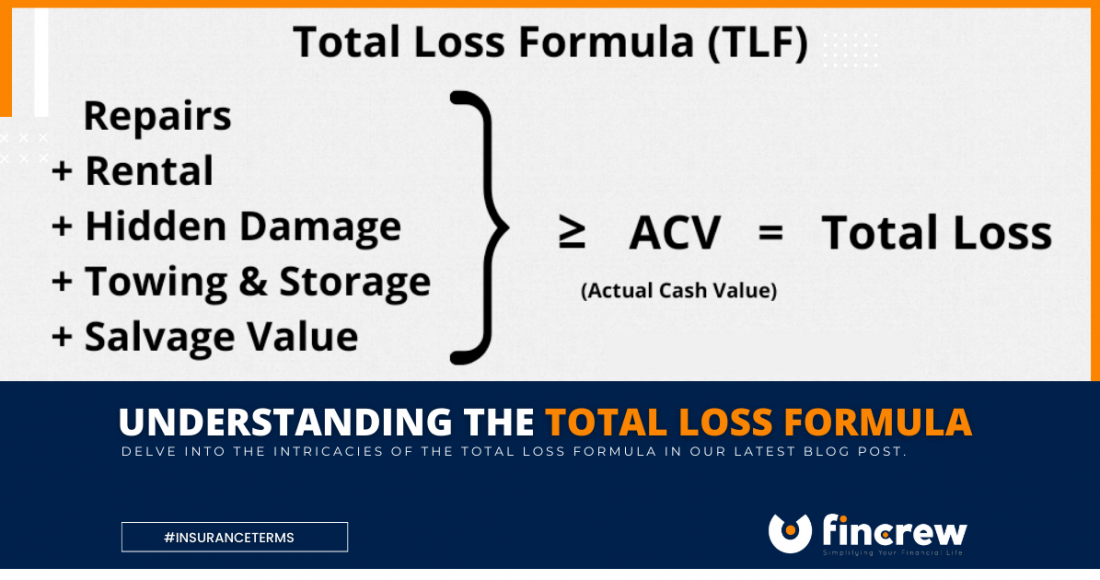

Two primary methods can determine a total loss. An absolute loss threshold is the first method; meanwhile, total loss thresholds are determined by a percentage of the vehicle’s market value. If the car meets or exceeds this threshold, it may be declared a total loss instead of being repaired. Another way to determine whether a car is a total loss is to use the Total Loss Formula (TLF). It is calculated as the fair market value less salvage value of a vehicle. If the costs of repairs exceed the TLF outcome, your auto insurer has the right to declare it a total loss.

What Can You Do If Your Car Has Been Declared a Total Loss?

You should know a few things about the total loss process if you receive a vehicle total loss declaration from your insurance company. It is suggested that you inform the leasing company that your vehicle has been totaled if you currently lease it. We’ve listed what you should do if your car has been declared a total loss below. Remove license plates. Take both license plates off the front and back of the vehicle. It can be problematic to leave your plates in a place where they might be stolen. As a safety precaution, you should keep the license plates.

Remove personal belongings. Look inside the vehicle after you remove your license plates. Check the dash, glove compartment, door, and seat pockets if you think something might be left in the trunk. You won’t get anything back from your keys once they are turned in in many cases. Let your claims adjuster have the keys. You must hand over all sets of keys to your claims adjuster once you have removed the plates and possessions from the car. Then, you will be given several documents you need to complete.

Make sure all paperwork is completed. You should complete and sign all paperwork provided to you by the claims adjuster. The car title will most likely be transferred to your insurance company at the end of this process, so you will no longer be responsible for the vehicle. Additionally, you can keep the car and restore it enough to qualify for a rebuilt title if you want to drive it again.